Overview

The majority of large businesses and asset managers today produce annual sustainability reports about their positive social and environmental initiatives. However, the measurements they use are inconsistent and often difficult for investors to analyse and compare.

What is needed is better data that clearly shows both positive and negative business impacts, challenging industry and investors to move beyond the desire not to do harm and embrace the ambition to do good. The result will be investment actively and intentionally channelled into areas where it can have the greatest positive benefits.

The ITF’s work is moving us towards a world in which investment decisions are thoroughly informed by the triple lens of risk, return, and impact. Without transparency, harmonisation and integrity, impact financing cannot reach its full potential to create a better world, nor can it be held properly accountable.

Our recommendations

The ITF’s aim is to give investors the power to compare the impact of investments and trigger a race to the top. Central recommendations include:

- Supporting the International Sustainability Standards Board in the creation of a global reporting baseline on impact related to enterprise value

- Building on that baseline to include impacts on stakeholders

- Mandatory impact accounting for businesses and investors to harmonised standards

- Supporting work to improve impact valuation methodology

Report

Report

Financing a better world requires impact transparency, integrity and harmonisation.

Greater transparency on impact, harmonised disclosure standards and better data for decision-making are the foundational elements needed to catalyse private capital at scale for people and planet.

Members

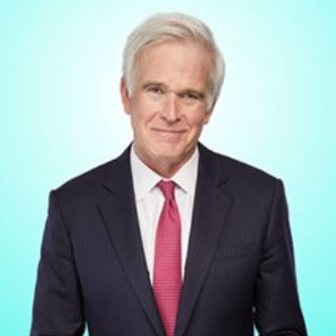

George Serafeim

Charles M. Williams Professor of Business Administration and Faculty Chair

Impact Weighted Accounts Initiative-Harvard Business School

Find out more »

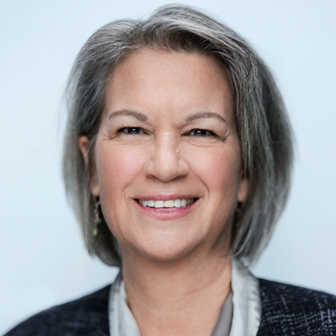

Karen Wilson

Senior Advisor

Centre on Well-being, Inclusion, Sustainability and Equal Opportunity (WISE)

Find out more »

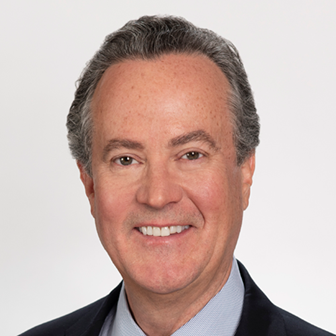

Mary Schapiro

Vice Chair for Global Public Policy and Special Advisor, Lead of the TCFD

Bloomberg

Find out more »

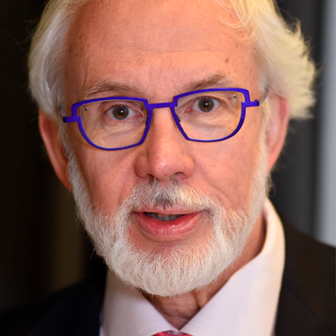

Prof. Ngaire Woods

Founding Dean

Blavatnik School of Government-University of Oxford

Find out more »

Prof. Weiguo Zhang

Former Board Member

IASB & Former Regulator at China Securities Regulatory Commission

Find out more »